In the realm of finances, the importance of data cannot be overstated – it reigns supreme. The abundance of data equips decision-makers with invaluable insights, empowering them to make informed choices.

In the dynamic environment of banking, where volatility and uncertainty are inherent, the adoption of cutting-edge technologies is imperative. Effective risk management is a cornerstone of stability and success in the banking industry. Accurate risk assessment and proactive mitigation strategies are essential for navigating the complex financial landscape with success.

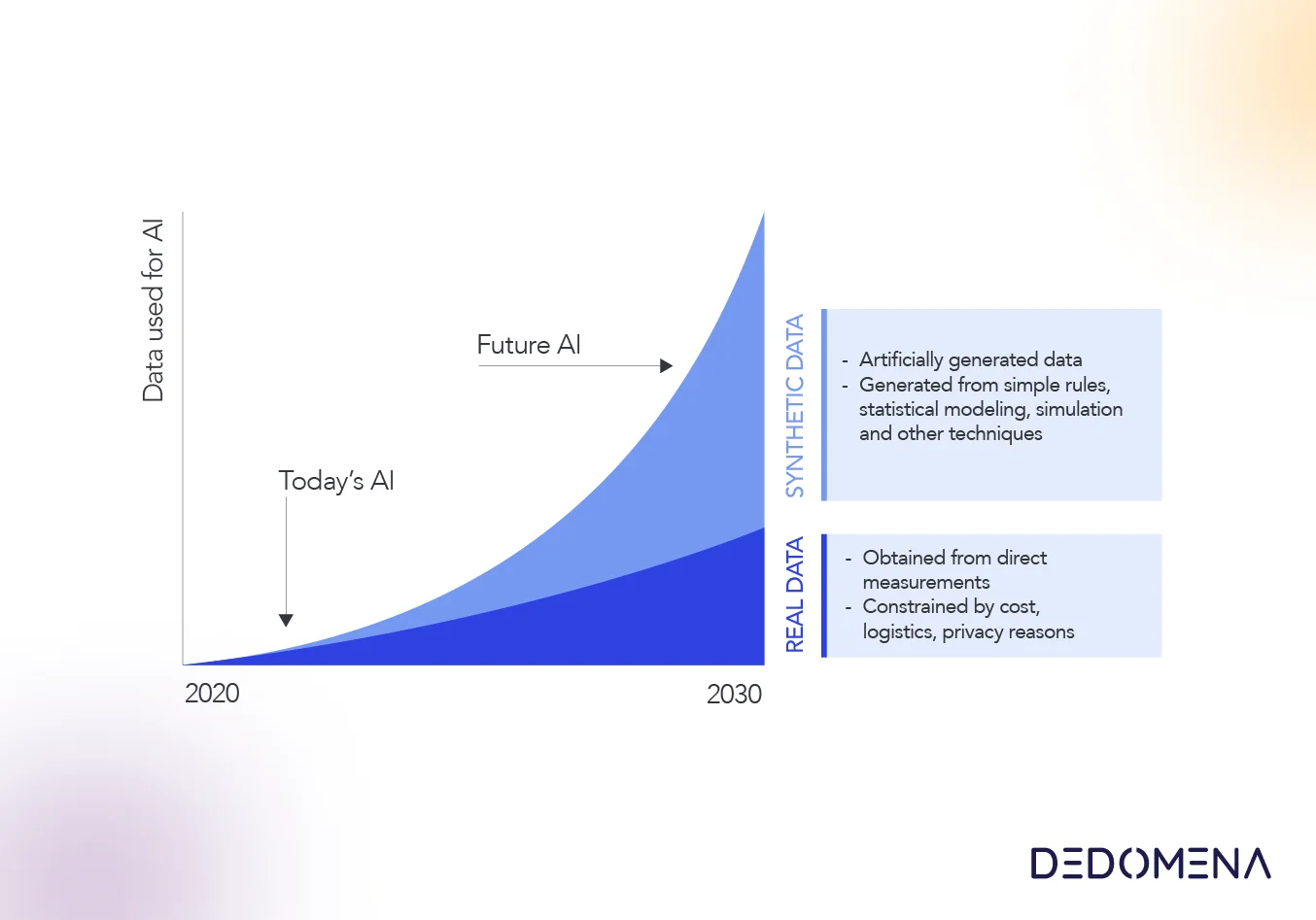

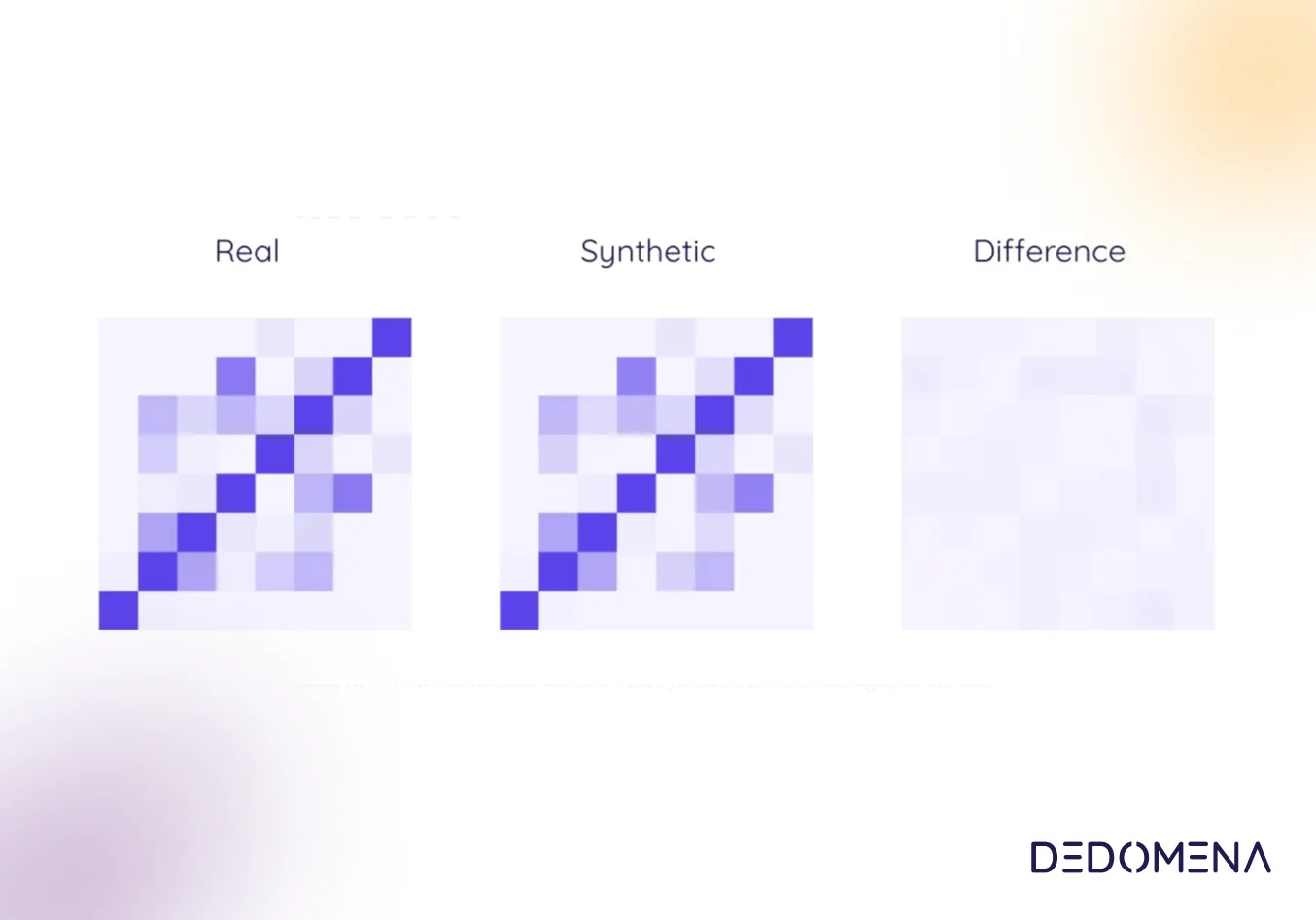

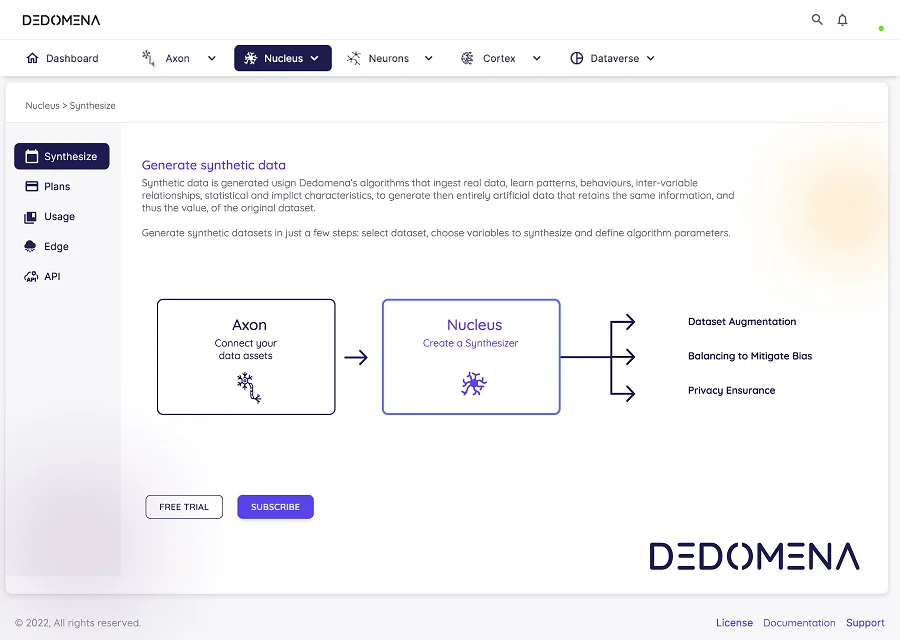

Synthetic data represents a paradigm shift, offering artificially generated datasets that faithfully replicate the statistical characteristics of real-world data. Artificial Intelligence and Machine Learning (ML) stands as one of the most robust areas where synthetically generated data offers numerous high-value applications.

In the context of risk management, in the banking sector, this innovation allows the creation of diverse scenarios, enabling machine learning models to learn and adapt to a broader spectrum of potential risks.

Elevated model training

Synthetic data facilitates the training of machine learning models on a more extensive and diverse set of scenarios, simulating different threat situations and allowing financial organizations to test and refine their risk management strategies before implementing them in the real world. By running simulations on synthetic data, organizations will better understand and anticipate risk and minimize losses while reducing the time and resources needed to develop their models.

This results in models that are not only more accurate but also more resilient when confronted with unforeseen challenges.

Preserving customer privacy

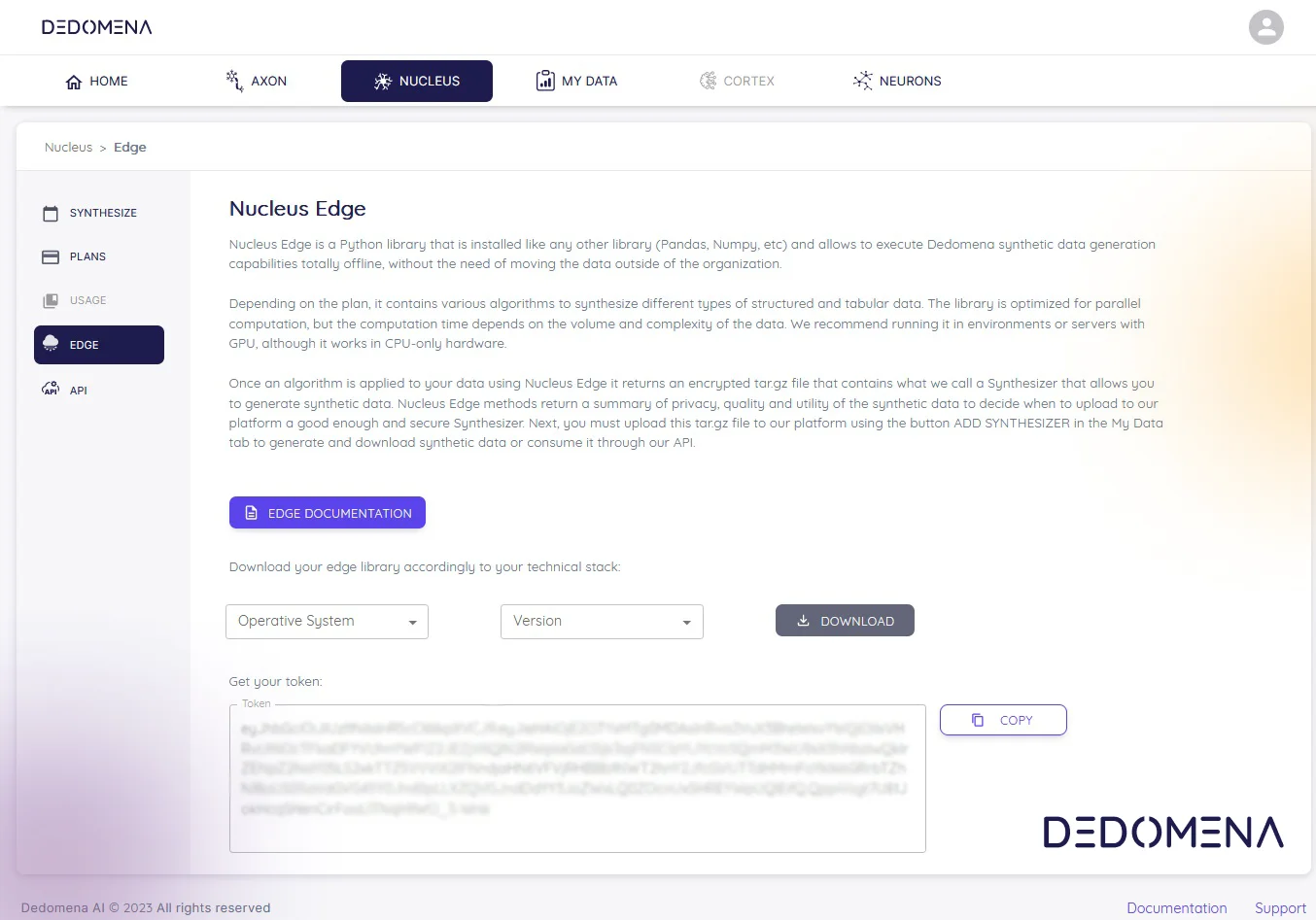

Privacy concerns surrounding customer data have been a longstanding challenge in risk management. Synthetic data addresses this issue by enabling the generation of realistic data without compromising individual privacy. This ensures compliance, during the training of ML models, with stringent data protection regulations.

Overcoming data scarcity challenges

In situations where real-world data is scarce, synthetic data becomes a valuable asset. This is particularly beneficial for training models on rare events or situations that may not be adequately represented in the available historical data.

For example, usually the risky observations in the data used to train machine learning models to anticipate situations such as card fraud, defaults, etc., account for less than 3% of the available data, with synthetic data being the best solution to facilitate algorithms and systems to learn and adequately identify these unwanted situations, saving time and money.

The ability of synthetic data to generate diverse and tailored scenarios enables the models to glean insights and patterns that might otherwise be overlooked, enhancing their adaptability and robustness in addressing unique and uncommon occurrences.

Adaptability to dynamic markets

Banking environments are inherently dynamic, with risks evolving over time. Synthetic data empowers machine learning models to adapt to changing market conditions by continuously generating new training data that accurately reflects the current risk landscape. Costs of operations can be reduced significantly when decision-making in acquisition and servicing is backed by efficient trained machine learning algorithms. Synthetic training data surpasses real data, not solely for privacy compliance reasons but also for enhanced effectiveness.

As banking organizations embrace these technological advancements, they position themselves not only to navigate current challenges but also to proactively shape the future of risk management in finance.

The integration of synthetic data into machine learning represents a transformative era for the banking sector. By enhancing model training, synthetic data empowers financial institutions to build robust risk management strategies. A small improvement in their performance can lead to significant savings and competitive performance.The synergy between synthetic data and machine learning promises to redefine how the banking industry anticipates and mitigates risks, fostering a more secure and resilient financial landscape.