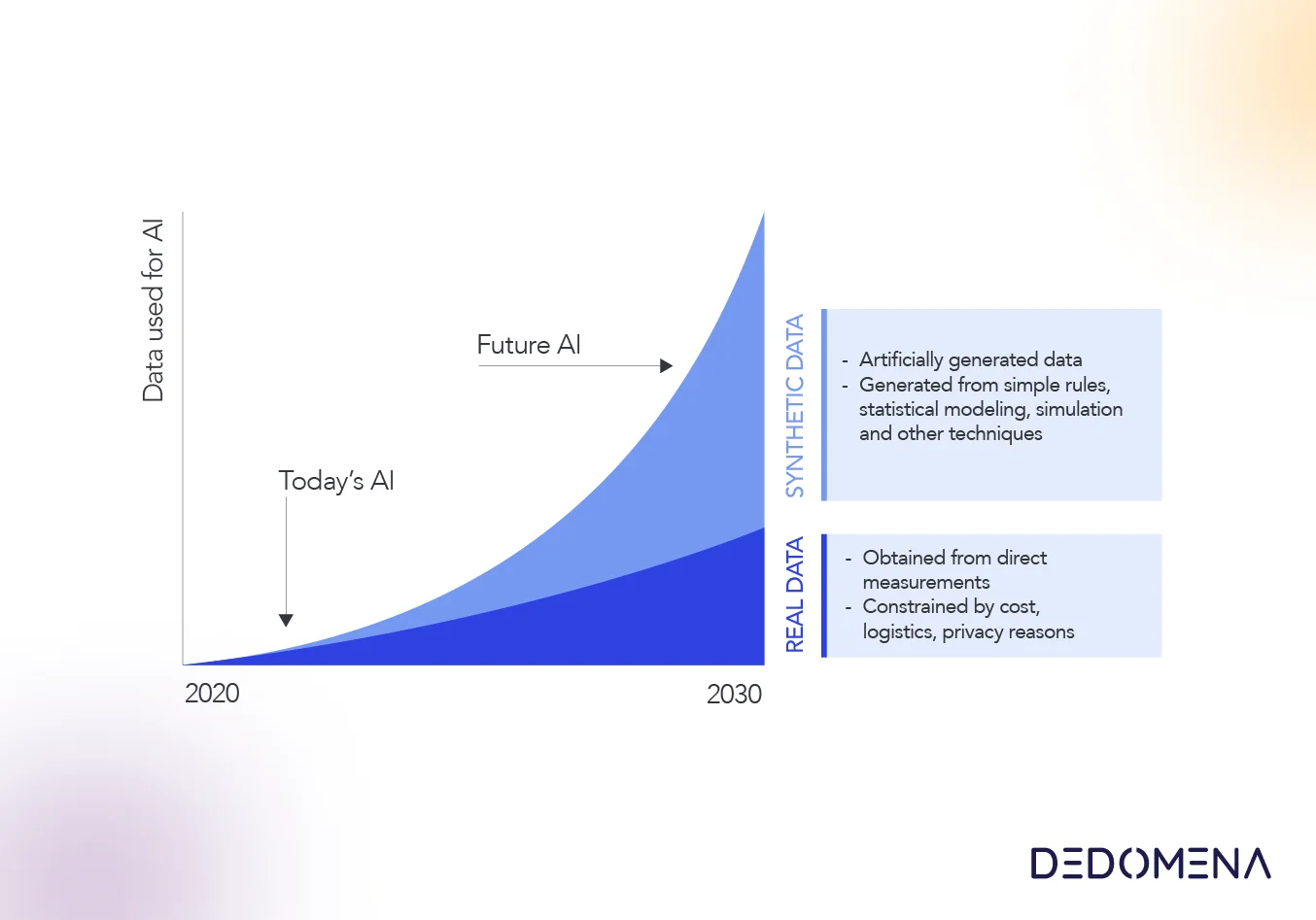

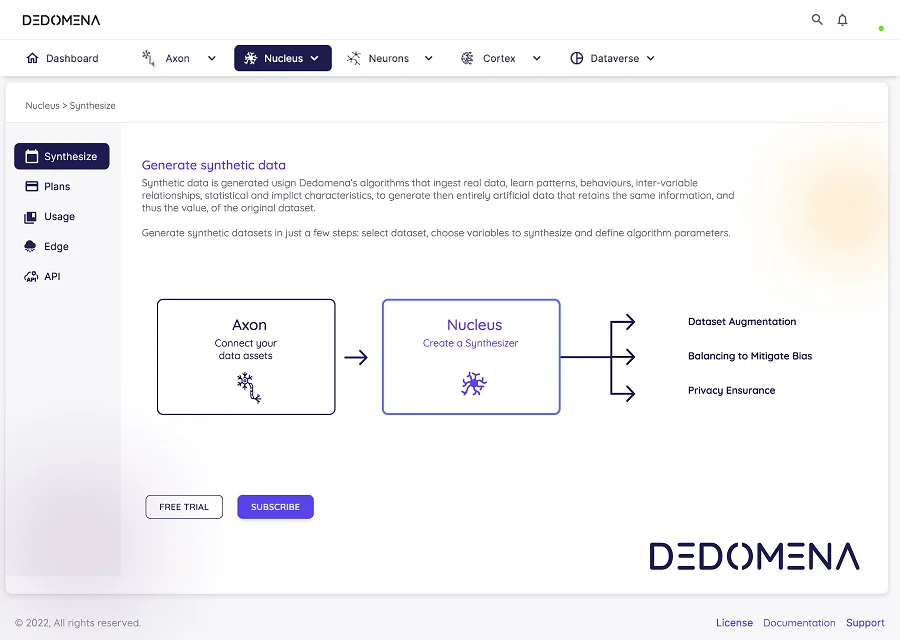

In the fast-paced realm of Artificial Intelligence (AI) and Machine Learning (ML), one concept has been making waves: synthetic data. While it's widely celebrated in areas like natural language processing and image recognition, its application to structured data—especially in the domain of fraud prediction—has sparked intriguing debates. In this blog post, we dive into the world of synthetic data and its remarkable influence on enhancing AI models. We'll showcase this impact through the lens of a global fintech juggernaut that harnessed synthetic data to fortify their fraud detection capabilities.

Our story unfolds in the corridors of a global fintech powerhouse, a company witnessing exponential growth with thousands of transactions coursing through its platform each month. Committed to delivering cutting-edge financial solutions, they empower users to transfer funds, make purchases, and conduct transactions with unparalleled ease.

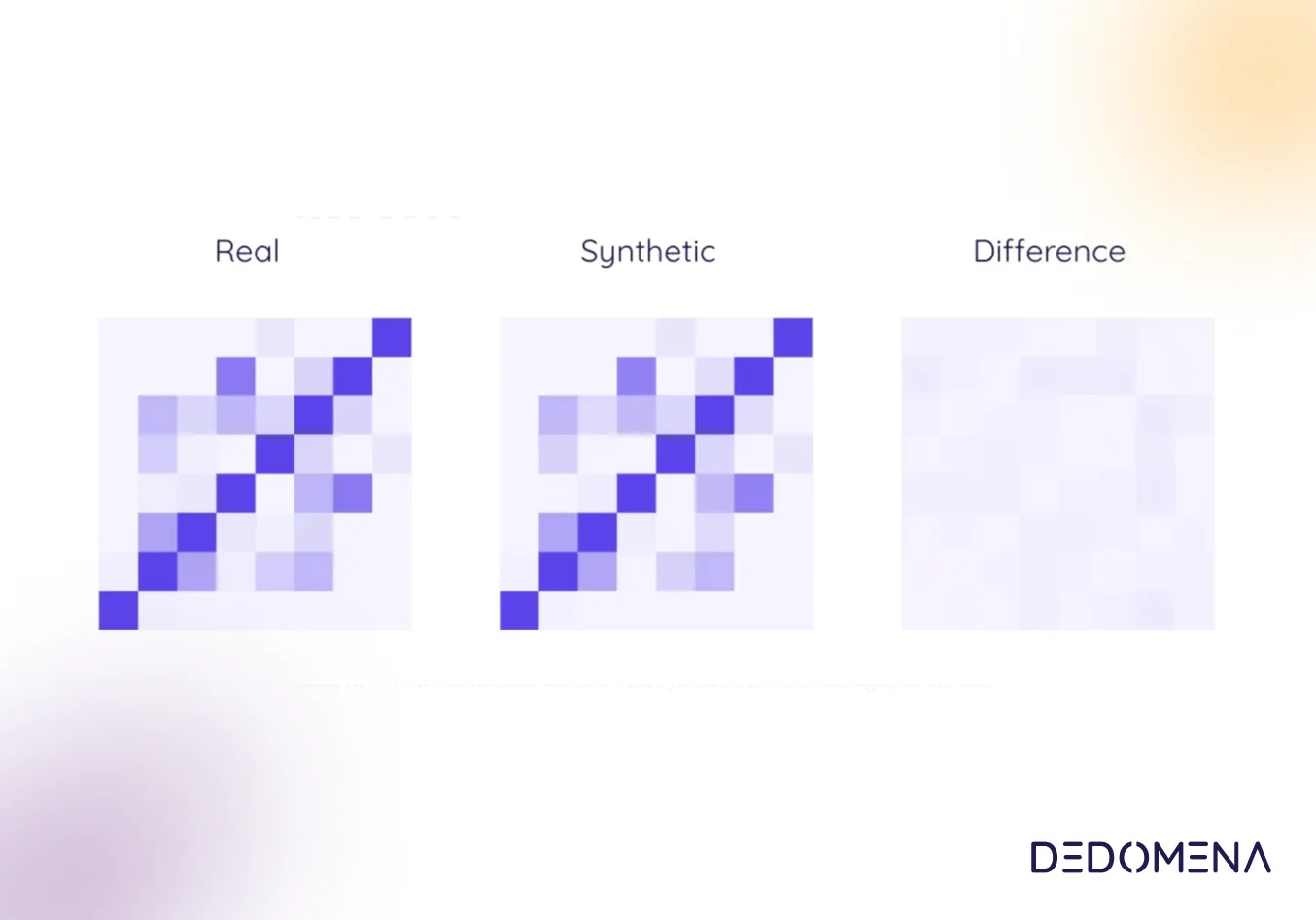

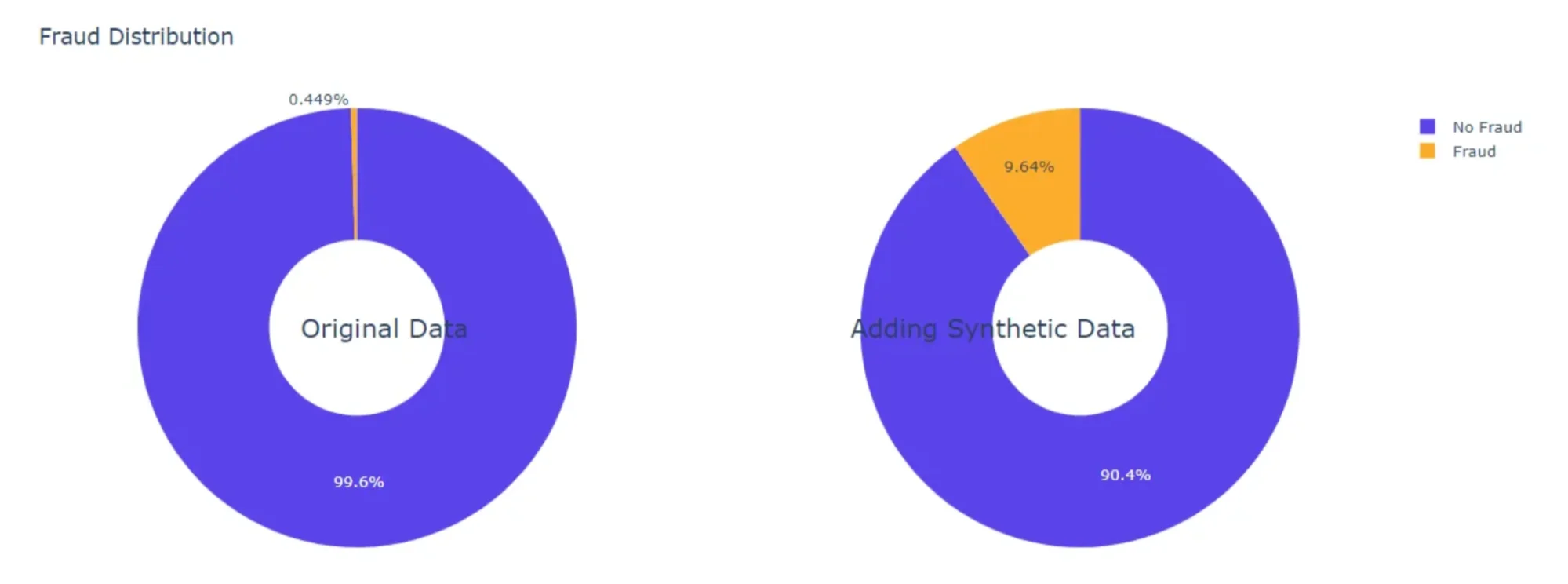

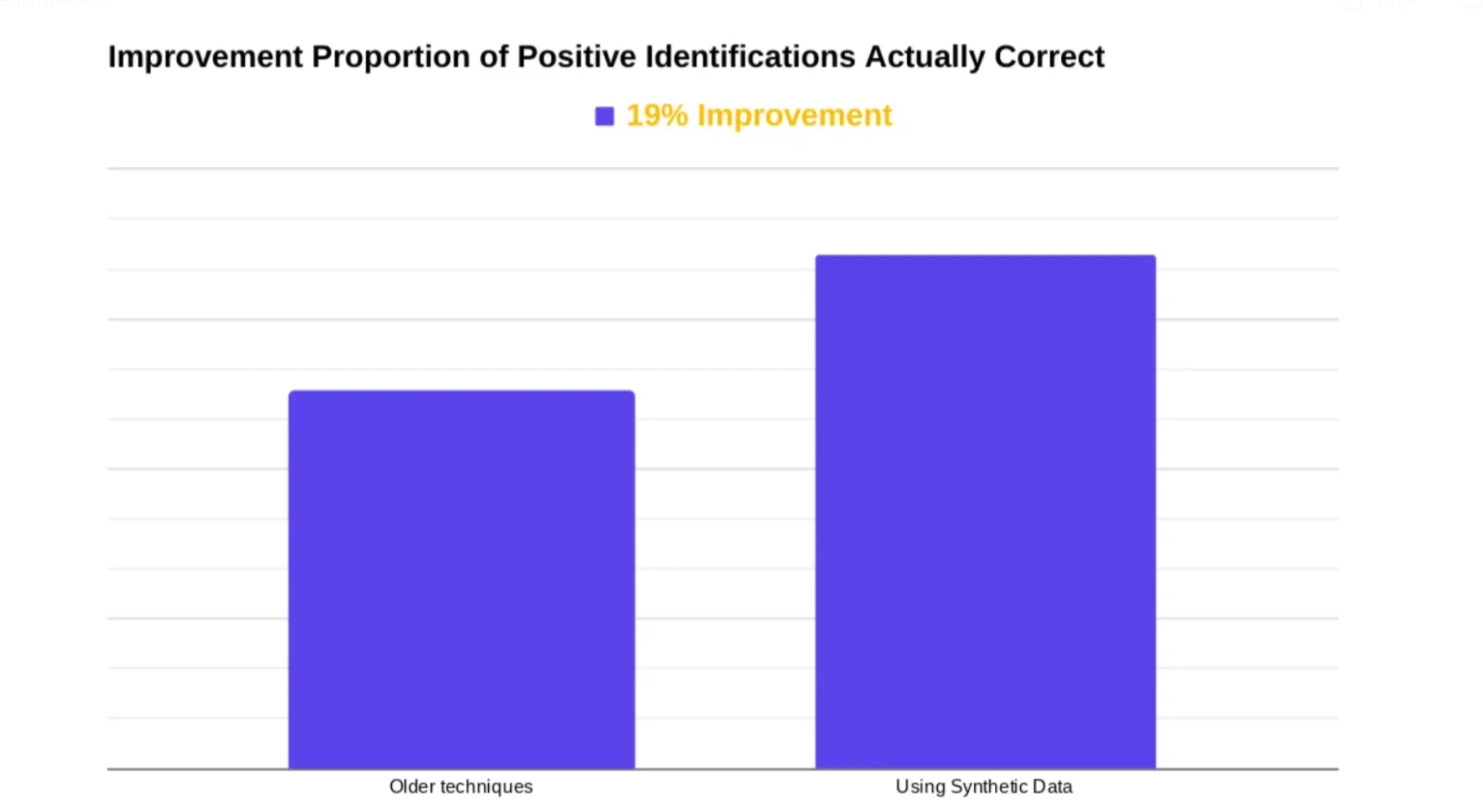

To assess the transformative potential of synthetic data, we embarked on a rigorous journey of comparison. We pitted models trained using conventional balancing techniques like undersampling and SMOTE against a model fortified by synthetic data. Our North Star in the quest for fraud detection excellence? Recall—a metric that answers the pivotal question: What proportion of actual fraud cases were correctly identified?

While the algorithms, architectures, and parameter configurations used in this endeavor remain confidential, our methodology adhered to industry best practices. Rigorous hyperparameter tuning and architecture refinement were the order of the day, all aimed at averting the common pitfalls of overfitting.

The fruits of our labor exceeded all expectations. While maintaining consistent Recall values to ensure a fair comparison, we rejoiced in a remarkable 19% surge in accurately identified fraud cases. Even in the face of the perplexing Accuracy Paradox, we celebrated a noteworthy uptick in overall accuracy, ascending by almost half a percentage point.

The implications of our journey are profound. The result is a more resilient model that excels in distinguishing both fraudulent and legitimate transactions, significantly reducing the incidence of false positives. This transformation underscores the potential of synthetic data to revolutionize AI and ML models, even in the structured data arena.

The implications of our journey are profound. The result is a more resilient model that excels in distinguishing both fraudulent and legitimate transactions, significantly reducing the incidence of false positives. This transformation underscores the potential of synthetic data to revolutionize AI and ML models, even in the structured data arena.